(NOTE: I wrote this piece in an effort to pass on some valuable knowledge I accumulated during nearly nine years in the church insurance field. I figure there are some church administrators and board members who could use this and might stumble across it while searching the net for information.)

NOTE 2: A 3o minute internet radio broadcast of this information is now available at by clicking on the player in the right-hand sidebar. It includes additional stories and examples not included in the printed version. You can listen to the broadcast at the link, or download it to your computer or iPod so it can be shared with your church staff or other pastors or leaders who could benefit from this information.

===============================================

I’m your church insurance agent’s worst nightmare. Now, why would a guy who usually writes and talks about politics want to do a post about church insurance? Well, my friends, it’s difficult to admit this, but I am a recovering church insurance agent. Yes, I’m sure you admire the courage that it took for me to admit that, but for nearly 9 years I worked for one of the largest church insurers in the country.

During those years I handled everything from little bitty start up congregations with 20 people meeting in a school cafeteria, to a 7,000 member megachurch with tens of millions of dollars worth of buildings and property and every activity known to man. I had conservative Baptist churches, Pentecostal churches, stuffy Presbyterian churches, mysterious Asian religions, a couple of mosques, independents of all types, and a fair number of cults. If you were a 501(3)c church and you weren’t burning witches at the stake, weren’t witches yourself, or weren’t passing out snakes during your Sunday services, our company would probably insure you.

During my countless hours on the road I often thought that if churches knew what I knew about the various pricing tricks insurance companies use to mysteriously find savings when a competitor comes calling, my life as an agent would be a lot tougher and churches would be paying a lot less in premium. I decided that if I ever found myself in a position where I could counsel and advise churches on this subject, I’d give them that information their agent doesn’t want them to know and help them keep more of their money for ministry and help them spend less on necessary evils like insurance.

When I entered the business I was naïve enough to believe that two identical churches in the same town with similar activities and loss history would probably have two very similar premiums. Not so. In fact, there could be a dramatic difference between the premiums paid by both churches, and what I’m going to show you here is how to make sure you’re taking advantage of the pricing options the insurance companies have that they don’t want you to know about.

Let’s get one thing clear at the beginning: Church insurance is not a ministry. It can help support you as you perform your ministry, but the companies are not providing coverage as a charitable act. Insurance is a business and the company’s goal is to extract as many dollars from your ministry as possible while paying out as few as possible in claims.

Now, before I go any further, let me just say that I’m not trying to imply here that the church insurance business is more unsavory than any other insurance business. You’ll find these same things going on with any insurance company. However, churches tend to put more trust than they should in church insurance companies just because they work primarily with churches. That trust will cost you a lot of money.

If an agent walks into your office carrying a Bible, throw him out! It’s an act designed to disarm you, and just because he carries an 18 pound gold embossed King James Bible with the original Greek and Hebrew manuscripts, doesn’t mean he still isn’t out to get your money. He may be a good guy, and may even be a dedicated Christian, but as your agent, the two of you are in a business relationship and you have to remember that

The larger church clients of mine often had full time staff members who served as administrators. These people were sometimes pastors with administrative backgrounds, or lay administrators with business management backgrounds. I enjoyed working with professional administrators since they had a great deal of knowledge about the subject and understood the importance of proper coverage. They could also be challenging, thanks to their business savvy and concern for the bottom line.

Smaller churches often had volunteer lay leaders, perhaps the pastor himself, or even the church secretary handling the insurance program. There were several occasions when I had to make a pitch to the part-time secretary who was then supposed to pass all my information on to the church board. That was usually a waste of time, and I’ll give you a suggestion regarding the proper contact person later on.

With all that having been said, here are a few rules you should take to heart when working with your insurance program:

-Don’t fall in love with your agent. You certainly want to have a good relationship with your agent since he’ll be more likely to respond favorably when you need something, but as they say, love is blind. I’ve seen churches willingly pay thousands of dollars more than they had to, and sometimes for less coverage, because they were so blindly in love with their agent. When you start to value your agent more than you value the ministry dollars you have to work with, you set yourself up for needless costs.

Your agent works for you – make him earn his money. If he brings you a box of candy at Christmas, thank him, eat the candy, but don’t forget insurance is still a business and if he isn’t competitive, you’ll spit him out like one of those chocolates with the coconut in them.

-Control your claims. You can’t help it if the little old lady falls down and hurts herself in your parking lot, but you can make sure your grounds and buildings are as free of hazards as possible. Be observant for things that can generate claims, because claims are your worst enemy when it comes to keeping your insurance costs down. Insurers assess loss ratios based on the dollar amount of claims paid versus the dollar amount in premium collected. Some also take into consideration the number of claims submitted, even if they were for small dollar amounts because there’s still an adjusting and underwriting cost associated with small claims. For the average insurance company, an account is considered profitable at anything below a 65% loss ratio. If you’re under that, the company is making money and they’re more likely to be willing to negotiate better rates for you.

For property claims, use your deductible as a guideline. If a claim situation arises that’s going to cost less than three times your deductible, pay it yourself and don’t file a claim. It will save you money in the long run. And speaking of deductibles, choose the highest deductible you can afford to pay on your own. Underwriters are more likely to grant credits on policies with high deductibles (more about credits later).

-Get competitive quotes every year. If you don’t do anything when your insurance renewal time comes up, I can almost guarantee you that your costs will go up, even if you haven’t had any claims. Sometimes that will be due to rate changes that may occur in your area, but often it’s due to company policies that dictate that they want a certain premium increase on existing accounts during that year. There were dozens of occasions when I got renewal worksheets from the company that showed a 5% increase in premium just because that’s what the company wanted. The customer hadn’t had any claims, and there weren’t rate changes in that territory. Because the church didn’t show any signs of shopping for other insurers, the increases sailed right on through. Your agent is probably paid based on a percentage of the premium you pay, so if he thinks you won’t mind an increase, he certainly won’t mind sending one your way.

So, how do they increase your rates even though there hasn't been a rate change? Easy. There's a little tool called "Special Risk Rating Credits" that can be applied to many policies that have the effect of adjusting the rates up or down according to the whims of the agent and the underwriter. There's an "official" list of reasons and allowable adjustments, such as Care and Condition of the Premises, or Management Cooperation, and each has an allowable percentage credit or debit. If any such credits or debits are applied, the agent has to complete a form to justify those changes. In theory, the agent should take that form, go down the various rating factors, and apply the appropriate credit or debit to each item to come up with the final percentage.

In reality, the agent and underwriter agree on the percentage of credit or debit they want to assess to the policy, and then work the form to justify the amount. For instance, if the agent thinks he needs 25% credit to be competitive and the underwriter agrees, he fills out the form accordingly. If the agent doesn't want to "leave money on the table", or perhaps the church is a start-up with no building and falls below the minimum desired premium, he can likewise apply a debit to the policy using the same process. If the company wants a 5% increase in premium, they just knock 5% off the credits at renewal time. There's more fiction writing done on Special Risk Rating forms than in the entire Harry Potter series. That's why it's so important to get a quote every year and keep the agent and the company on its toes.

What’s the process? Here’s what you should do about two months before your property/liability package comes up for renewal:

Contact your existing agent and request hard copy loss runs. That will do three things for you: -It will give you loss information that you can use when negotiating rates with other carriers (assuming the loss run looks good);

-It will put your existing carrier on notice that you’re shopping, and will make them more likely to sharpen their pencils a bit when calculating your renewal;

-It will make your existing agent nervous, and a nervous agent is your best friend.

You probably have a desk full of cards and mailers from other church insurers. Call them all. Two months lead time is plenty for most insurers to gather information and prepare a quote. If you have a very large church with individual buildings that would be valued at $5 million or more, you may want to start this process 3 months early since there could be some reinsurance issues that will take more time to quote.

Don't pay your bill until you absolutely have to. Your insurance won't get canceled if you don't pay your renewal bill a month early. Even if your payment is a day or two late there are regulations which prevent the insurance company from cancelling your policy on the renewal date.

I'm not advising you to pay late, just don't pay too early. The companies bill you early for a variety of reasons, but none of those are because they benefit you the customer. here's what happens when you send your money before you have to:

-You give the insurance company free money to use which they can invest and make money on, none of which will benefit you. It's better for you to keep the money in your account until you have to pay it.

-Secondly, an early payment tells the agent that the deal is done and he'll keep the business. Therefore, he doesn't need to spend any extra time and effort to try and retain your business. His work is finished.

-Thirdly, you make it more difficult in the event another agent wants to submit a bid late in the process. Usually the first thing they'll ask you is if you've paid your bill, and if you have, they may still give you a bid but they probably won't put that much effort into it since the assumption will be that the buying decision has already been made. If you haven't paid yet the agent will have more incentive to give you his best deal (especially if you follow the advice below and released all the information to him).

Keep your money in your pocket as long as you can. There's nothing like an unpaid premium bill a few days before renewal to motivate your agent to get creative in order to keep your business.

Full disclosure. This item will probably tick off the insurance industry more than anything. When a competing agent comes to your church, pull out your insurance policy, premiums and all, and let him look at whatever he wants. If he wants copies of the coverages and pricing, give it to him.

Why? If an agent knows what he’s competing with, especially in terms of pricing, he’s more likely to come back with a quote that’s superior to what you currently have. Some administrators believe it’s unfair to reveal pricing and coverages to a competitor. I could buy the unfairness argument if information is being revealed to only one side, but full disclosure means everybody gets to see everything. The competitor coming in gets to see the existing policy, and the current agent gets to see the competitive quotes. When the dust finally stops flying, you’re going to end up with the best deal.

Have the decision makers there when the agents present their proposals. There’s nothing worse for the agent or the church than having the agent give his best presentation to somebody who’s not empowered to make the decision. If the decision makers are not present, somebody will have to translate that presentation for them and much will be lost in the translation. You want to make sure the right people are hearing directly from the agent and have the opportunity to ask questions.

Don’t be afraid to set up a dog-and-pony show some evening. You can get the board members together and give each agent a specified amount of time to make his pitch. That way everybody hears the same things and it will be easier to come to a group decision (for those churches that make these kinds of decisions by committee).

And now, a caveat to this whole thing. Many of the large mainstream denominations have group programs that are outstanding. The programs often have huge property and liability limits and are priced very competitively. The downside is usually service. One of my pet peeves as an agent was the occasions when the boss would insist that we solicit business from churches that had these group programs. My company couldn’t touch them and we knew it, but the guy with the rose-colored glasses would always insist that we could win these accounts away with our charm and good looks. After looking at these massive group programs I felt I was doing a disservice to the client by trying to convince them to abandon a clearly superior program just so they could see my smiling face from time to time.

Look folks, service is a wonderful thing and you want great service from your agent, but if he can’t match the multi-million dollar blanket coverages that you find on these big group programs, don’t switch. He may come back with something that saves you a few bucks and he’ll promise to return your phone calls and name his firstborn after you, but when you compare costs relative to coverage, you’ll be making a bad decision if you leave the group program.

A little knowledge, planning, and effort on your part can save your ministry a lot of money, and since I haven’t seen the church yet that has too much money, I’m sure you can find better uses for it than paying insurance premiums. Meanwhile, I’m going to head off to the Insurance Agent Witness Protection Program so I can remain safe from all the insurance companies and agents who are now out to get me.

====================================================

Related Tags: Church Insurance, Church Mutual Insurance, GuideOne Insurance, Brotherhood Insurance, Philadelphia Insurance, Church Mutual, GuideOne, Insurance For Religious Organizations, Insurance For Churches, Church Insurance Programs, Church Insurance Agent

Tuesday

Purpose Statement

The church insurance business is a game, a contest between the church and the insurer. You'd like to think you're working together, but let's be serious. The insurer wants to collect as much premium as possible from you while paying the least amount in claims, and the church is trying to pay the least amount in premium while getting the big problems paid by the insurer. It's a competition.

In any fair game both sides know and understand all of the rules, but that's not true of the church insurance game. The insurers know the rules, but the churches only know what the insurer or their experience has told them about the rules. It's sort of like playing poker and only one guy knows that two pair beats two aces, so when you show your pairs of 2's and 3's, he tells you his pair of aces wins and if you don't know better, you give him all your chips.

This website is designed to help even the playing field a bit by giving churches more knowledge of the rules of the game so they can compete evenly with, or perhaps even gain an advantage over, the insurance companies. I won't be discussing specific coverage at this site - that's a discussion you should have with your agent.

The most important post on this site is "What Your Churches Insurance Agent Doesn't Want You to Know". I've detailed many of the rules of the game in that post and it's a must-read for any church preparing to negotiate their insurance deal. There is also an audio version of this information which you can listen to my clicking on the player in the right-hand sidebar. Your church insurance agent won't like it, but nobody likes to lose an advantageous negotiating position.

I'm also going to use this site for two other purposes. I'm going to tell you some stories from my church insurance days, some funny, some irritating, but all true. Some of the things happened to me, and some I heard from others. I won't give you the names of the companies I worked for, the name of the agency or the people I worked with, nor will I mention the names of the church clients and prospects I worked with. There's no sense in poking the bear more than I have to.

I'm also going to talk about people management, or more correctly, how not to manage people. During my years in the church insurance business I was witness to and victim of some of the poorest people management skills I've ever seen in a person who was not the homicidal dictator of some banana republic. Think Hugo Chavez with a Lexus. That's why I describe myself as a "recovering church insurance agent". Whether you work in insurance or any other field involving people, these stories will be instructive.

This post will stay at the top of the page. New posts will appear beneath it.

Related Tags: Church Insurance, Church Mutual Insurance, GuideOne Insurance, Brotherhood Insurance, Philadelphia Insurance, Church Mutual, GuideOne, Insurance For Religious Organizations, Insurance For Churches, Church Insurance Programs, Church Insurance Agent

In any fair game both sides know and understand all of the rules, but that's not true of the church insurance game. The insurers know the rules, but the churches only know what the insurer or their experience has told them about the rules. It's sort of like playing poker and only one guy knows that two pair beats two aces, so when you show your pairs of 2's and 3's, he tells you his pair of aces wins and if you don't know better, you give him all your chips.

This website is designed to help even the playing field a bit by giving churches more knowledge of the rules of the game so they can compete evenly with, or perhaps even gain an advantage over, the insurance companies. I won't be discussing specific coverage at this site - that's a discussion you should have with your agent.

The most important post on this site is "What Your Churches Insurance Agent Doesn't Want You to Know". I've detailed many of the rules of the game in that post and it's a must-read for any church preparing to negotiate their insurance deal. There is also an audio version of this information which you can listen to my clicking on the player in the right-hand sidebar. Your church insurance agent won't like it, but nobody likes to lose an advantageous negotiating position.

I'm also going to use this site for two other purposes. I'm going to tell you some stories from my church insurance days, some funny, some irritating, but all true. Some of the things happened to me, and some I heard from others. I won't give you the names of the companies I worked for, the name of the agency or the people I worked with, nor will I mention the names of the church clients and prospects I worked with. There's no sense in poking the bear more than I have to.

I'm also going to talk about people management, or more correctly, how not to manage people. During my years in the church insurance business I was witness to and victim of some of the poorest people management skills I've ever seen in a person who was not the homicidal dictator of some banana republic. Think Hugo Chavez with a Lexus. That's why I describe myself as a "recovering church insurance agent". Whether you work in insurance or any other field involving people, these stories will be instructive.

This post will stay at the top of the page. New posts will appear beneath it.

Related Tags: Church Insurance, Church Mutual Insurance, GuideOne Insurance, Brotherhood Insurance, Philadelphia Insurance, Church Mutual, GuideOne, Insurance For Religious Organizations, Insurance For Churches, Church Insurance Programs, Church Insurance Agent

Thursday

The Drive-in Church

The City of Orange is where the Crystal Cathedral got its start when they first started meeting in a local drive-in theater. Today another Orange church had a drive-in experience (from the OC Register):

If the church doesn't own that building they'll find out how good their liability coverage is, especially if the driver's insurance is insufficient. Many policies for tenants exclude coverage for the building they're renting.

A woman suffered moderate injuries after she crashed her vehicle into a church Thursday morning, authorities said.Turns out there really isn't room in the sanctuary for parking, so next week they'll have to leave their cars outside like usual.

Police got a call shortly after 10 a.m. regarding a crash at the Heritage Christian Fellowship, 7436 E. Chapman Ave., near Newport Boulevard, authorities said.

Officers found a Toyota Camry driven by a woman crashed through a glass door and window, Orange police Sgt. Dan Adams said.

If the church doesn't own that building they'll find out how good their liability coverage is, especially if the driver's insurance is insufficient. Many policies for tenants exclude coverage for the building they're renting.

Toddler Drowns in Church Baptismal Pool

A church's nightmare:

A 1-year-old boy is dead after he drowned in an Indianapolis church’s baptismal pool Wednesday.Whatever the church's liability limits are, they're going to use all of it...and probably then some.

Indianapolis police said the boy — identified as Juan Cardenas in several reports — went missing for a short period, presumably having wandered off from the supervision of childcare staff members at the Praise Fellowship Assembly of God. There, eight employees monitor between 30 and 45 children.

The child wasn’t discovered missing until his therapist arrived for a session and couldn’t find him. The daycare employees then found him floating in two-feet of water in the pool. He was transported in critical condition to St. Vincent’s Hospital where he was later declared dead.

Monday

Churches to Be Kicked Out of NYC School Buildings January 1

Having spent 9 years in the church insurance business, which included providing coverage for dozens of churches that met in schools, this could start a troubling trend across the country:

During my insurance days I insured all kinds of denominations that met in public schools. Never once did a school district apply any sort of standard as far as the type of church they allowed, nor did they provide any kind of support that could be misconstrued as "state sponsoring". The judge's ruling is nonsense.

Churches that meet in schools in other parts of the country should take note and have contingency plans at the ready. The anti-religious activists will be emboldened by this decision and will seek to spread their bias nationwide.

The Supreme Court has rejected an evangelical church’s plea to overturn New York City’s ban on renting public schools for religious worship services. That means the city now has a green light to begin evicting congregations who pay rent to use public school buildings for church services.Look at the twisted reasoning that went into this decision:

The Supreme Court’s decision not to hear the case leaves in place a federal appeals court ruling that upheld the city’s policy.

The court case involved the Bronx Household of Faith – a church that paid weekly rent to hold worship services at a public school since 2002. The church, along with five dozen other congregations, was allowed to continue worshipping at public schools pending the outcome of the lawsuit.

It’s a sad day for religious liberty,” said Jordan Lorence, the church’s attorney and senior counsel for the Alliance Defense Fund. “Churches and religious other groups should be allowed to meet in public buildings on the same terms as other community groups and they’re being denied that in New York City.”

The 2nd U.S. Circuit Court of Appeals determined that allowing churches to use schools resulted in an “unintended bias in favor of Christian religions” – since most Christian churches worship on Sunday.This is stupid on so many levels. Although I believe a city or school district should have the right to determine who uses their facilities and when, schools are being hammered all across the country with budget cuts. These churches provide much needed revenue to the districts, and they're generally very good tenants, careful not to mess up teacher's rooms or in any way do damage to the school facility. This is easy money for the districts, but the anti-religious zealots just can't stand the idea that something that values God can have any contact with a public facility.

“Jews and Muslims generally cannot use school facilities for their services because the facilities are often unavailable on the days that their religions principally prescribe for services,” Judge Pierre Leval declared. “At least one request(ed) to hold Jewish services (in a school building used for Christian services on Sundays) was denied because the building was unavailable on Saturdays. This contributes to a perception of public schools as Christian churches, but not synagogues or mosques.”

Judge Leval also took issue with the evangelical church’s membership. “Bronx Household acknowledges that it excludes persons not baptized, as well as persons who have been excommunicated or who advocate the Islamic religion, from full participation in its services.” Leval wrote.

But it all boiled down to a key point, the judges decided. “In the end, we think the board could have reasonably concluded that what the public would see, were the Board not to exclude religious worship services, is public schools, which serve on Sundays as state-sponsored Christian churches,” Leval wrote.

During my insurance days I insured all kinds of denominations that met in public schools. Never once did a school district apply any sort of standard as far as the type of church they allowed, nor did they provide any kind of support that could be misconstrued as "state sponsoring". The judge's ruling is nonsense.

Churches that meet in schools in other parts of the country should take note and have contingency plans at the ready. The anti-religious activists will be emboldened by this decision and will seek to spread their bias nationwide.

Tuesday

Church Arsonist Pleads Guilty, But You'll Never Guess Why He Did It

Having been in the church insurance business I know there are a variety of people out there with grudges against churches that can actually provoke them to try and burn the building. However, this one is unusual even for that crowd:

A Huntington Beach man pleaded guilty Tuesday to arson and other charges for setting three fires at an Irvine church and attempting to set a fourth.And here comes the reason for his arsonist rage:

Izad Chavoshan, 32, faces a sentence from Superior Court Judge Craig E. Robison on Aug. 19 ranging from probation to 20 years in prison.

Chavoshan pleaded guilty to three counts of arson, one count of attempted arson and a hate crime sentencing enhancement. He also has a prior strike conviction for criminal threats in 1998.

Prosecutors contended that Chavoshan drove to the Orange County Church of Christ in Irvine on three nights between Oct. 15, 2009, and Oct. 19, 2009, moved trash cans to the front of the church and set them on fire. Church employees reported the fires to Irvine police, who monitored the church Oct. 21, 2009.

Chavoshan returned to the church on that night and repeatedly threw a trash can at the glass portion of the front doors, according to a news release from the Orange County District Attorney's Office. He then removed a pack of matches from his pocket, lighted a piece of paper and attempted to push it between the closed church doors, prosecutors said.

He was arrested at the scene.

Prosecutors said Chavoshan was disgruntled with the church's teachings against masturbation.Well, he'll have plenty of opportunity to contemplate that issue in the state prison.

Friday

Church Insurer Becomes Target of Angry Wisconsin Union Teachers

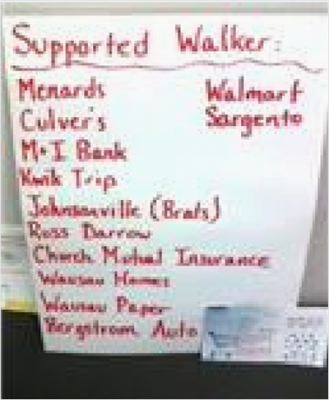

This picture was taken in a teacher's lounge inside a high school in Wausau, WI. It identifies Wisconsin companies the unions accuse of supporting Gov. Scott Walker (h/t Gateway Pundit):

I used to work for one of those companies - Church Mutual, based in Merrill, WI. I don't remember them being particularly political, but I never really saw their political activities in Wisconsin.

Given how few of the most activist union teachers actually attend church, I doubt it will be much of a threat to their business.

I used to work for one of those companies - Church Mutual, based in Merrill, WI. I don't remember them being particularly political, but I never really saw their political activities in Wisconsin.

Given how few of the most activist union teachers actually attend church, I doubt it will be much of a threat to their business.

Wednesday

A.M. Best Downgrades Rating of Church Mutual Insurance

I missed this story when it originally ran on May 28, 2010, but it was pointed out to me by a former Church Mutual agent:

I guess they don't have to worry about that anymore.

I left the business in 2007. Things started going bad in 2008 and 2009. Just sayin'.

A.M. Best Co. has downgraded the financial strength rating to A (Excellent) from A (Superior) and issuer credit rating to “a ” from “aa-” of Church Mutual Insurance Company (Church Mutual) (Merrill, WI). The outlook for both ratings has been revised to stable from negative.From personal experience I can tell you that Church Mutual was almost paranoid about maintaining their A+ Superior rating, and agents were instructed to make that a regular selling point against the opposition (not that most customers really cared). At that time I think they'd had the rating for almost 50 years. One year we had to practically shut down all new policy production by September because they were afraid their reserve situation and A.M. Best rating would be imperiled if we put too much business on the books. Things must have really begun to go south if they were finally downgraded.

The rating actions reflect the sharp decline in Church Mutual’s reported underwriting performance in 2008, 2009 and through first-quarter 2010, driven primarily by competitive market conditions and significant catastrophe-related losses recorded in these years. As a result, Church Mutual’s underwriting results and operating performance measures have deteriorated to levels that are no longer reflective of a Superior-rated company.

Church Mutual recorded an underwriting loss of $24.2 million in 2009, following an underwriting loss of $26.9 million in 2008. In addition, the company reported an $11.1 million underwriting loss in first quarter 2010. Church Mutual’s catastrophe-related losses were driven by losses associated with the high frequency of weather-related events in 2008 and 2009 and the severity of Hurricane Ike in 2008.

The rating actions also consider A.M. Best’s concern that Church Mutual’s operating earnings will not return to historical levels, given the ongoing challenges the company faces to improve underwriting results over the near term due to the competitive environment in its specialty niche market and its continued exposure to weather-related losses. Additionally, given the magnitude of Church Mutual’s catastrophe-related losses in recent years, in addition to the high level of investment losses posted in 2008, A.M. Best remains concerned with management’s overall risk management.

I guess they don't have to worry about that anymore.

I left the business in 2007. Things started going bad in 2008 and 2009. Just sayin'.

Sunday

The Shredder

I think I've been out of the business long enough now to tell this story.

One morning I got a call from a church in my territory that was going to lose its Work Comp coverage with a competitor because of one large claim. Looking at their loss history they'd been a very clean risk, but the other company was trying to shed clients because of reserve problems so they decided to cancel this Work Comp policy.

My company would not write a stand alone WC policy but insisted on getting the entire church's package. "No problem", was the response from the church and I made an appointment to go see them the next day.

In my office I had a file cabinet full of old quotes done by agents who had worked the territory before me. Before I went to a church that was new to me I always checked that file to see if an old quote was in there that might have building drawings or other useful information. If the drawings were there it could save me a lot of time while at the church. This particularly church had a number of buildings, so finding the drawings was a pleasant surprise. Probably knocked 90 minutes of grunt work off my appointment.

As I looked through the file I found that this account had been submitted for coverage to my company about 10 years earlier but had been rejected. There was no reason marked for the rejection - just the underwriter's name and date. It was a different underwriter than was servicing the area now, and back at that time rejections or underwriter notes weren't entered online - they were only kept in old archive files at which nobody ever looked. The current underwriter would have no information about this church readily available to him.

I thumbed through all the underwriting information that had been submitted and everything looked fine...until I found a copy of a 12-year old lawsuit that had been filed in Oakland in which a woman accused a church's pastor of sexual misconduct during a counseling session. The name of the Oakland pastor was the same as the pastor of the church I was about to go see.

Nowhere in the file was there any documentation regarding the disposition of the case. I couldn't tell if it had been tossed out, settled in one party's favor, or had been won by the plaintiff. It's rare for these things to go to trial so I assumed some sort of settlement had occurred.

Now I had a choice. If I mentioned the old lawsuit and company rejection to my underwriter one of the following would surely occur:

One morning I got a call from a church in my territory that was going to lose its Work Comp coverage with a competitor because of one large claim. Looking at their loss history they'd been a very clean risk, but the other company was trying to shed clients because of reserve problems so they decided to cancel this Work Comp policy.

My company would not write a stand alone WC policy but insisted on getting the entire church's package. "No problem", was the response from the church and I made an appointment to go see them the next day.

In my office I had a file cabinet full of old quotes done by agents who had worked the territory before me. Before I went to a church that was new to me I always checked that file to see if an old quote was in there that might have building drawings or other useful information. If the drawings were there it could save me a lot of time while at the church. This particularly church had a number of buildings, so finding the drawings was a pleasant surprise. Probably knocked 90 minutes of grunt work off my appointment.

As I looked through the file I found that this account had been submitted for coverage to my company about 10 years earlier but had been rejected. There was no reason marked for the rejection - just the underwriter's name and date. It was a different underwriter than was servicing the area now, and back at that time rejections or underwriter notes weren't entered online - they were only kept in old archive files at which nobody ever looked. The current underwriter would have no information about this church readily available to him.

I thumbed through all the underwriting information that had been submitted and everything looked fine...until I found a copy of a 12-year old lawsuit that had been filed in Oakland in which a woman accused a church's pastor of sexual misconduct during a counseling session. The name of the Oakland pastor was the same as the pastor of the church I was about to go see.

Nowhere in the file was there any documentation regarding the disposition of the case. I couldn't tell if it had been tossed out, settled in one party's favor, or had been won by the plaintiff. It's rare for these things to go to trial so I assumed some sort of settlement had occurred.

Now I had a choice. If I mentioned the old lawsuit and company rejection to my underwriter one of the following would surely occur:

- He'd reject the client outright.

- He'd require me to go confront the pastor with this old lawsuit and try and get some type of proof of the disposition before he'd decided about the church's insurance.

- He'd agree to write a church policy but would exclude the pastor from the coverage.

None of those three were acceptable to me. It was a fairly large account, the client had a time crunch in which to get this done, and if no one in the current leadership at this church was aware of this old case it could be quite upsetting to the pastor and the church.

I looked again at the loss run from the church which covered more than 10 years. There wasn't a single incident or report of any problems involving the pastor or anyone else in the church regarding similar misconduct. Given the time that had passed I made the unilateral decision to ignore the old lawsuit. I took it out of the old file in my office, took it home with me and ground it up in my shredder.

A complete package of policies was written for the church and I had them as clients for several years until I left the business. During that time they paid tens of thousands of dollars in premiums, had zero claims of any kind, and made me, the agency and the company a ton of money. It was a good call, but one that would have gotten me in trouble had it been known at the time.

Sometime you just have to go with your gut instincts.

(By the way, you'll notice that I didn't give any information in this post that would allow someone to figure out which church I'm talking about. I did that both to protect the church from harassment by the insurer, and because I know if anyone from my old agency's management team reads this it will drive them nuts.)

(By the way, you'll notice that I didn't give any information in this post that would allow someone to figure out which church I'm talking about. I did that both to protect the church from harassment by the insurer, and because I know if anyone from my old agency's management team reads this it will drive them nuts.)

Subscribe to:

Comments (Atom)